How Profitable Is Running a Solana Validator Node? A Real-World Case Study

Discover the actual earnings, costs, and profitability of running a Solana validator node. Learn from real data showing $100K+ annual revenue with 450K SOL staked.

How Profitable Is Running a Solana Validator Node? A Real-World Case Study

You've probably heard about Solana validators earning thousands of dollars monthly. But is it actually true? Can you really make money running a Solana node, or is it just another crypto pipe dream that sounds great on paper but fails in reality?

Let me share something exciting: after approximately one year of operating a Solana validator, one operator finally crossed into profitability—and that's with a 0% commission rate, meaning they're not taking any cut from stakers' rewards.

With over 450,000 SOL staked (that's more than $50 million at current prices) and people trusting this validator to secure their investment and cover inflation costs, the numbers tell a compelling story. Let's break down exactly how profitable running a Solana validator can be, looking at real data from an actual validator that started just over a year ago.

What Does It Really Mean to Be Profitable as a Validator?

Before we jump into the numbers, let's get clear on what profitability means in the validator world. It's not just about seeing some SOL tokens hit your wallet. You've got real costs: hardware, hosting, voting fees that add up quickly, and your time managing the infrastructure.

Profitability means your rewards exceed all these costs. For many validators starting out, this takes months to achieve because you need substantial stake to generate enough rewards to cover your operational expenses. The validator we're examining hit this milestone after roughly a year—and here's the wild part: they did it while charging absolutely nothing to their stakers.

Think about that for a second. They're giving away 100% of the staking rewards to delegators while still managing to turn a profit from transaction fees and MEV (Maximal Extractable Value). That's the power of Solana's fee market and the network's incredible activity levels.

The Real Numbers: Breaking Down Validator Revenue

Let's get into the actual data using the Smart Validator Toolkit (svt.one), which provides detailed statistics for any Solana validator.

Current Stake and Market Value

As of early January 2025, this validator has:

- Current stake: ~546,000 SOL

- SOL price: ~$110 (at time of writing)

- Total value: Over $60 million in delegated stake

When you see those numbers, it hits differently. People are entrusting tens of millions of dollars to this validator, expecting optimal APY (Annual Percentage Yield) to offset the inflation happening on the Solana chain.

Income Per Epoch: Where the Magic Happens

Solana operates in periods called "epochs," each lasting approximately 2-2.5 days (mostly around 2 days). Each epoch brings both costs and rewards.

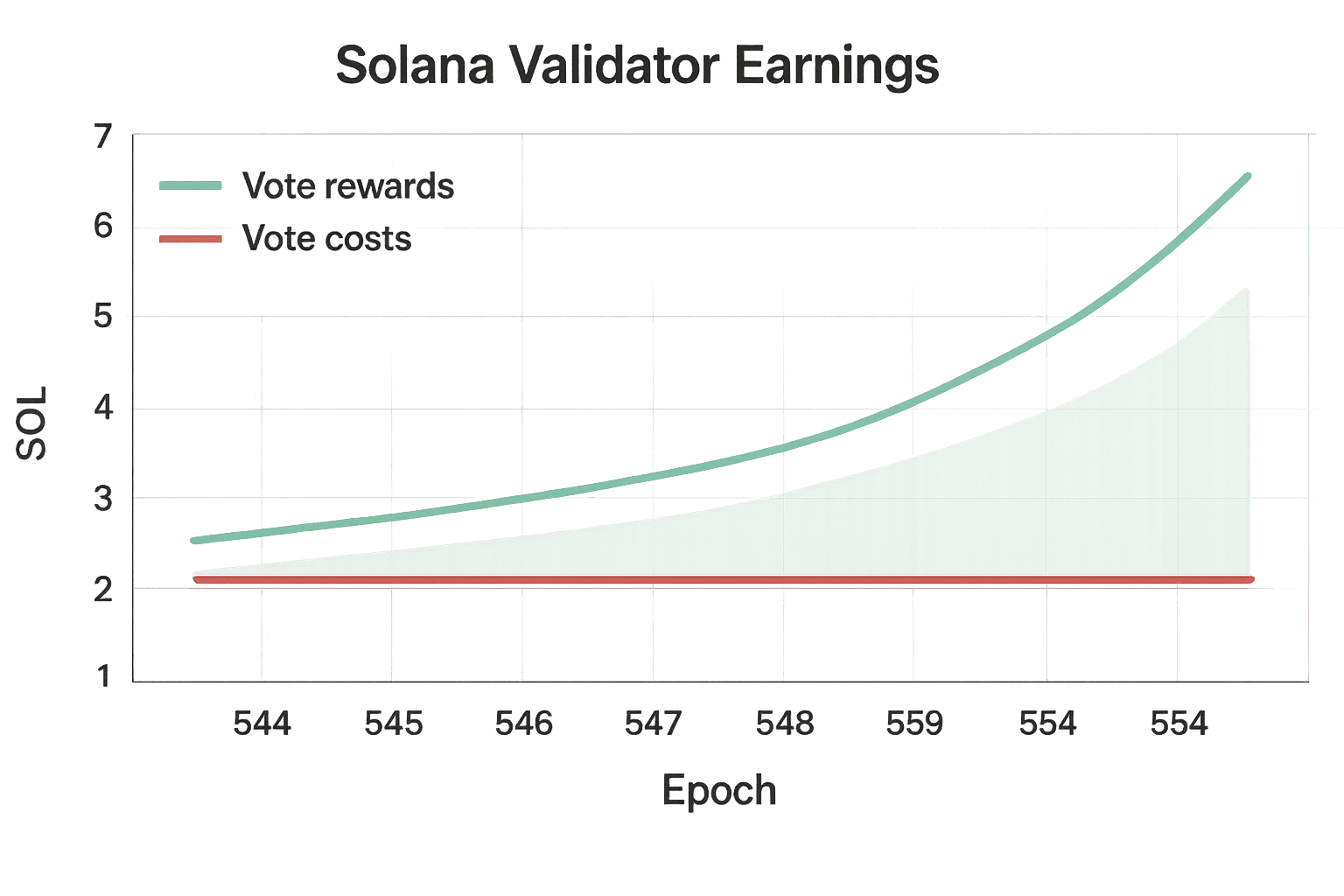

Vote Costs (in red on the chart):

- Approximately 1.8 SOL per epoch

- This is the fee validators must pay to participate in consensus

- You vote on whether transactions are valid

- It's a fixed cost you can't avoid

Vote Rewards and Transaction Fees (the good stuff):

- Recent epochs have shown dramatic increases

- Epoch 553: 2.43 SOL in pure profit (after vote costs)

- Epoch 552: 6.5 SOL in pure profit

- Epoch 551: Similar strong performance

Looking at the last 10 epochs (roughly 20 days), the pattern is clear: Solana network usage has exploded. More transactions mean more fees, and those fees flow to validators.

Evolution of validator earnings showing vote rewards (green) vs vote costs (red) over recent epochs. The growing gap represents increasing profitability as network activity surges.

Evolution of validator earnings showing vote rewards (green) vs vote costs (red) over recent epochs. The growing gap represents increasing profitability as network activity surges.

The Fee Distribution Model

Here's how Solana's fee structure works:

- Transaction Fees: Users pay fees to execute transactions

- Burn Mechanism: 50% of transaction fees are burned (removed from circulation)

- Validator Rewards: The other 50% goes to validators as rewards

- Priority Fees: Recent innovation allowing localized fee markets

- Prevents network-wide price increases during local congestion

- These also flow to validators

- Huge boost during high-activity periods

MEV Revenue: The Hidden Profit Stream

Beyond standard transaction fees, validators earn from MEV (Maximal Extractable Value). Think of this as the value validators can extract by strategically ordering transactions within blocks.

MEV Numbers from Real Data:

- Lifetime MEV rewards: ~7 SOL over the validator's existence

- Recent epochs: ~0.7 SOL per epoch average

- Trend: MEV tips are increasing significantly

- Impact: Nearly covers half the voting fees

Recent MEV rewards per epoch:

- 1.2 SOL

- 0.3 SOL

- 0.5 SOL

- 0.9 SOL

- 0.57 SOL

- 0.47 SOL

The latest epoch looked set to be another big one, demonstrating how MEV is becoming an increasingly important revenue stream as Solana activity grows.

The Math: What Are You Actually Earning?

Let's calculate annual earnings based on recent performance.

Conservative Estimate

Average per epoch (looking at recent trends): ~5 SOL in net profit

Calculation:

- 183 epochs per year (365 days ÷ 2 days per epoch)

- 5 SOL per epoch × 183 epochs = 915 SOL annually

- At $110 per SOL = $100,650 per year

Including MEV Revenue

Additional MEV (conservative): 0.7 SOL per epoch

- 0.7 SOL × 183 epochs = 128 SOL annually

- At $110 per SOL = $14,080 additional

Total annual revenue: $100,650 + $14,080 = $114,730

And remember, this is with relatively modest stake. Some validators have 10x more stake (4.5 million SOL) and consequently earn 10x the revenue—over $1 million annually.

The Costs: What You Need to Spend

Revenue is only half the equation. Let's talk about what it costs to run a professional Solana validator.

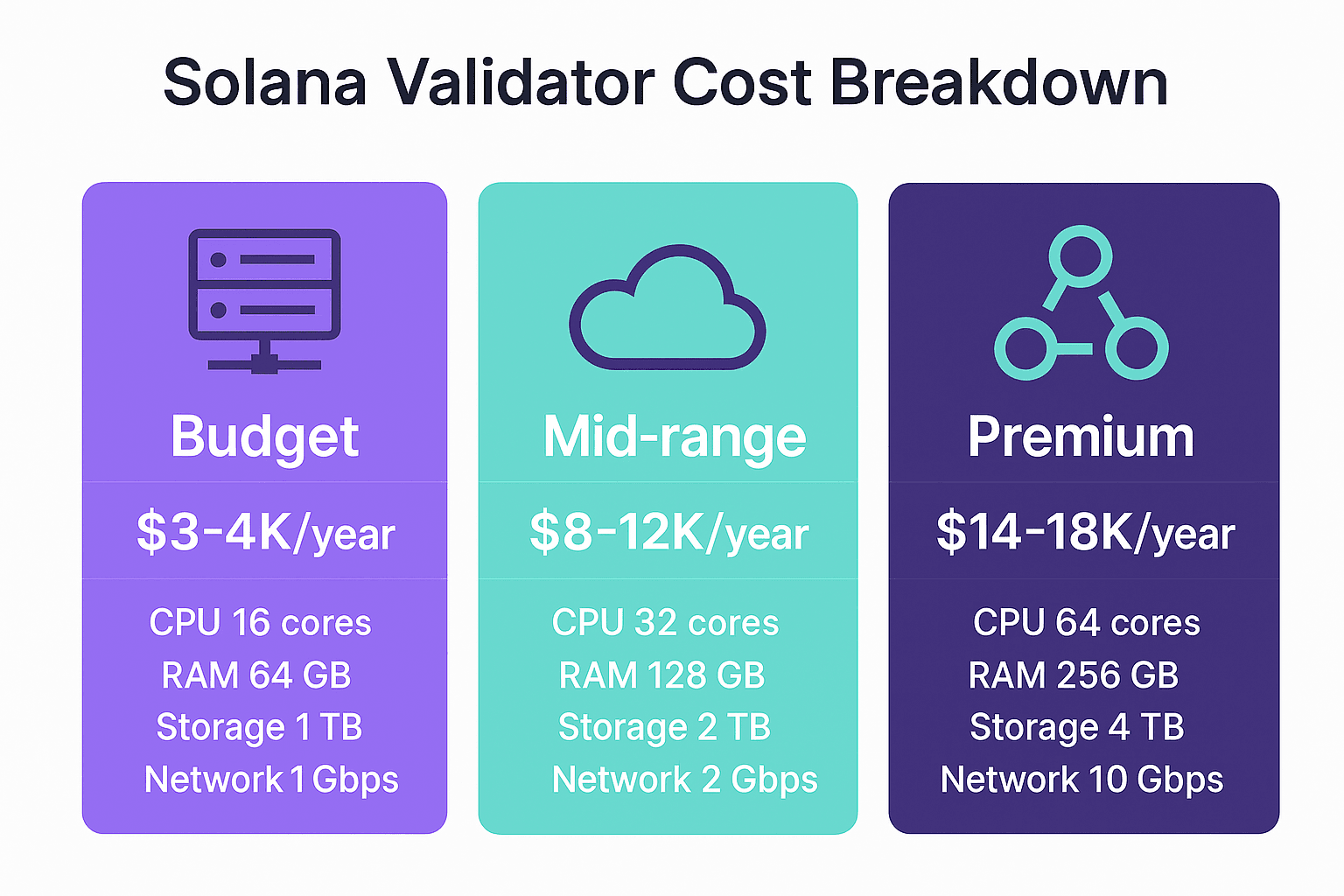

Three-tier cost structure for Solana validators: Budget ($3-4K/year), Mid-range ($8-12K/year), and Premium ($14-18K/year) with corresponding hardware specifications.

Three-tier cost structure for Solana validators: Budget ($3-4K/year), Mid-range ($8-12K/year), and Premium ($14-18K/year) with corresponding hardware specifications.

Voting Fees (Already Deducted)

The good news: the profit numbers we discussed already have voting fees subtracted. At approximately 1.8 SOL per epoch, that's about 329 SOL per year or $36,190 annually at current prices. But don't worry—this is baked into our profit calculations above.

Hosting Costs

This varies significantly based on your setup:

Budget-Friendly Approach:

- $300-400 per month if you're skilled at finding good deals

- $3,600-4,800 annually

Mid-Range Setup:

- $700-1,000 per month for reliable hosting

- $8,400-12,000 annually

Premium Infrastructure:

- $1,200-1,500 per month for top-tier performance

- $14,400-18,000 annually

Hardware Investment

Bare Metal Server Package:

- CPU: 12 cores/24 threads minimum, preferably 16+ cores

- RAM: 256 GB (some validators use 512 GB for better performance)

- Storage: 2TB+ NVMe SSD (fast I/O is critical)

- Network: 1 Gbps connection minimum

Cost options:

- Rental: $850-2,000 per month (includes hosting)

- Purchase: $8,000-15,000 upfront, then hosting fees

Total Annual Operating Costs

Let's calculate with mid-range hosting ($10,000 annually) and assuming rental hardware (included in hosting):

Annual costs: $10,000-20,000

Net profit (using conservative revenue estimate):

- Revenue: $114,730

- Costs: -$15,000 (average)

- Net profit: ~$99,730

That's nearly $100K annually in net profit after all expenses.

The Time Investment: Is It Worth Your Time?

Running a validator isn't passive income, but it's not a full-time job either.

Time requirements:

- Initial setup: 40-80 hours (learning, configuration, testing)

- Ongoing management: 5-10 hours per week

- Monitoring performance

- Applying software updates

- Responding to issues

- Community engagement

Skills needed:

- Linux system administration

- Basic networking knowledge

- Comfort with command line

- Troubleshooting ability

The good news: The Solana Discord community is incredibly helpful. Experienced validators regularly assist newcomers. If you're serious about learning, you can absolutely figure this out even without deep technical background.

The Catch: Getting to Profitability Takes Time

Here's the honest truth: this validator took approximately one full year to reach profitability while operating at 0% commission.

Why so long?

The Stake Acquisition Challenge

Validators need substantial stake to generate meaningful rewards. But why would someone stake with a new, unproven validator when established ones offer similar or better APY?

Common strategies:

- 0% Commission: Offering maximum rewards to attract delegators

- Community Building: Active engagement in Discord, Twitter, forums

- Reliability: Consistent uptime and performance builds reputation

- Unique Value: Offering additional services or benefits

This validator chose the 0% commission route, essentially operating at a loss initially to build trust and attract stake.

The Network Activity Factor

Timing matters. This validator's path to profitability accelerated recently because Solana network usage exploded:

- More decentralized applications launching

- Increased DeFi activity

- NFT trading volume

- Memecoin frenzy

- Growing adoption post-FTX recovery

Higher network activity = More transaction fees = Higher validator rewards

Scaling Up: How Bigger Validators Print Money

Let's look at the economics for validators with more stake.

Scenario: 4.5 Million SOL Staked

If you have 10x the stake of our case study validator:

Revenue multiplication:

- Base profit: $100,000 × 10 = $1,000,000

- MEV revenue: $14,000 × 10 = $140,000

- Total: ~$1.14 million annually

Cost structure (costs don't scale linearly):

- Hosting: Still around $15,000-20,000 annually

- Net profit: ~$1.12 million

The economics get dramatically better at scale. Once you've proven yourself and attracted significant stake, the profit margins become exceptional.

The Top Validators' Economics

The largest Solana validators manage billions in staked SOL and earn millions annually. Their advantages:

- Established reputation: Years of consistent performance

- Foundation delegations: Solana Foundation stakes with quality validators

- Network effects: Success breeds more success

- Commission revenue: Unlike our 0% case study, most charge 5-10%

Real Talk: The Risks and Challenges

Let's be honest about the downsides and risks.

Market Volatility

Our calculations assume SOL at $110. But crypto is volatile:

- SOL at $50: Annual revenue drops to ~$52,000

- SOL at $200: Annual revenue jumps to ~$209,000

Your actual dollar earnings fluctuate with SOL price, though your SOL earnings remain consistent.

Network Activity Uncertainty

Transaction fee revenue depends on network usage:

- High activity: $100K+ annually (as we've seen recently)

- Low activity: Could drop to $30-50K annually

- Bear market: Might barely cover costs

The Solana network still has massive capacity (could handle 10-20x more activity), but predicting usage is impossible.

Technical Challenges

Real problems validators face:

- Downtime: Missing votes means lost rewards

- Software bugs: Updates sometimes break things

- Network issues: Congestion can cause problems

- Competition: Thousands of validators competing for stake

Opportunity Cost

The big question: Is validator operation the best use of your capital and time?

Alternatives to consider:

- Simple staking: Earn 7-8% APY with zero effort

- DeFi strategies: Potentially higher yields (with higher risk)

- Development: Building on Solana might be more lucrative

The Testnet Opportunity: Low-Risk Entry Point

Here's an insider tip: Solana occasionally runs incentivized testnet programs.

Tour de Sol Program Example

The validator in our case study participated in Tour de Sol 22, an incentivized testnet validator program:

Investment:

- $850 per month for hosting + hardware package

- Less than 10 months of operation

- Total cost: ~$8,000

Returns:

- Over $100,000 earned

- Net profit: ~$92,000

Risk profile:

- Testnet environment (lower stakes)

- Fixed costs with uncertain returns

- Required technical expertise

Testnet programs offer a way to learn validator operations with real incentives while building reputation before running a mainnet validator.

Who Should Run a Solana Validator?

Running a validator isn't for everyone. Here's who benefits most:

Ideal Candidates

The Technical Entrepreneur:

- Comfortable with Linux and system administration

- Willing to learn and troubleshoot

- Can commit 5-10 hours weekly

- Has $15-30K for first-year investment

The Solana Believer:

- Long-term bullish on Solana ecosystem

- Wants to contribute to network security

- Values being part of infrastructure

- Willing to start with 0% commission

The Infrastructure Operator:

- Already runs servers or services

- Can leverage existing expertise

- Marginal cost to add validator operation

- Sees synergies with other activities

Who Should Probably Skip It

The Passive Investor:

- Just wants exposure to SOL price appreciation

- Better off staking with established validators

- No interest in technical operations

The Impatient Profit-Seeker:

- Needs immediate returns

- Can't wait 6-12 months for profitability

- Won't invest time in community building

The Non-Technical:

- No interest in learning system administration

- Gets frustrated by technical problems

- Can't commit to ongoing maintenance

The Solana Validator Landscape in 2025

Understanding the current ecosystem helps set realistic expectations.

Network Statistics

- Total validators: ~1,900+ active validators

- Total staked: ~370 million SOL (~60% of total supply)

- Average stake per validator: ~195,000 SOL

- Competition: High, with established validators dominating

Recent Developments

Network Improvements:

- SIMD-0256 upgrade (July 2025): Increased computational units per block

- Firedancer client (coming): Expected to push 1M+ TPS

- Priority fees: Better fee market design benefiting validators

- Improved stability: Fewer network issues than 2022-2023

Institutional Interest:

- SEC-approved Solana futures ETFs (March 2025)

- PayPal stablecoin launch on Solana (May 2024)

- Visa partnerships exploring Solana

- Growing real-world use cases

These developments point to increasing network activity, which directly benefits validators through higher fee revenue.

The Future Outlook

Bullish factors:

- Solana's technical capacity far exceeds current usage

- Growing institutional adoption

- Strong developer community

- Continued infrastructure improvements

- Increasing DeFi and NFT activity

Bearish factors:

- Market cycles affect activity levels

- Competition from other Layer 1 chains

- Regulatory uncertainty

- Technical challenges as network scales

How Validator Revenue Connects to gRPC Infrastructure

Here's something many new validators miss: providing quality data access can be a revenue multiplier.

The Data Access Opportunity

Validators have direct access to blockchain data. Smart validators monetize this by:

Offering RPC Services:

- JSON-RPC endpoints for developers

- WebSocket connections for real-time data

- High-performance gRPC streams

Why Developers Pay:

- Public RPCs are often rate-limited

- Latency matters for competitive applications

- Reliability is worth paying for

- Specialized data access needs

The gRPC Advantage

Modern applications increasingly prefer gRPC over traditional JSON-RPC:

Performance benefits:

- 70% lower latency (sub-100ms vs 300-400ms)

- 60-80% bandwidth reduction

- Real-time streaming capabilities

- Better compression with Protocol Buffers

Revenue opportunity: Validators offering high-performance gRPC access can charge premium prices to:

- DeFi applications needing real-time data

- MEV bots requiring minimal latency

- Analytics platforms processing high volumes

- NFT marketplaces tracking sales

Some validators generate an additional $10-50K monthly providing premium data access, essentially doubling their revenue.

Practical Steps: Your Path to Running a Profitable Validator

Ready to explore validator operation? Here's your action plan.

Phase 1: Education (Weeks 1-4)

Learn the basics:

- Read official Solana validator documentation

- Join Solana Discord validator channels

- Study existing validator setups

- Understand economics and requirements

Recommended resources:

- Solana documentation (docs.solana.com)

- Solana Discord validator channel

- Smart Validator Toolkit (svt.one)

- Solana Beach (solanabeach.io)

Phase 2: Testnet Experience (Weeks 5-12)

Get hands-on:

- Set up testnet validator

- Practice configuration and management

- Learn troubleshooting

- Build monitoring systems

Key skills to develop:

- Linux system administration

- Solana CLI operations

- Performance optimization

- Incident response

Phase 3: Mainnet Preparation (Weeks 13-16)

Production readiness:

- Secure quality hosting or hardware

- Set up production monitoring

- Prepare backup systems

- Plan stake acquisition strategy

Financial preparation:

- Budget $15-30K for first year

- Plan for 6-12 months until profitability

- Set aside emergency fund

- Consider testnet opportunities first

Phase 4: Launch and Growth (Month 4+)

Go live:

- Deploy mainnet validator

- Start with 0% or low commission

- Engage with community

- Build reputation through reliability

Growth tactics:

- Maintain >99% uptime

- Participate in Discord discussions

- Share validator updates

- Offer unique value (like gRPC access)

Advanced Strategy: Combining Validator Operation with gRPC Services

The smartest operators don't rely solely on staking rewards.

The Infrastructure Stack

Core validator operation:

- Earns transaction fees and MEV

- Provides network security

- Generates ~$100K annually (at 450K SOL stake)

Add RPC/gRPC services:

- Leverage existing infrastructure

- Minimal additional cost

- Potential $10-50K monthly revenue

- Adds $120-600K annually

Total potential: $220-700K annually from same infrastructure

Why gRPC Makes Sense

Validators already process all network data. Offering high-performance gRPC access:

Minimal overhead:

- Use existing hardware

- Small additional bandwidth cost

- Some monitoring infrastructure needed

Strong demand:

- Developers need reliable data access

- Performance-sensitive applications pay premium

- Growing ecosystem needs infrastructure

Competitive advantage:

- Not all validators offer this

- Technical expertise is a moat

- Build long-term customer relationships

Getting Started with gRPC Services

Don't have the expertise to set up gRPC infrastructure yourself? Focus on what you do best—running a reliable validator—and partner with specialists for the data access layer.

Solana gRPC provides production-grade infrastructure so you can offer your community and customers high-performance data access without building it yourself.

Benefits of partnership approach:

- No infrastructure development needed

- Professional monitoring and support

- Focus on validator performance

- Revenue share opportunities

Real-World Validator Strategies

Let's look at different approaches validators use successfully.

Strategy 1: The Patient Builder (Our Case Study)

Approach:

- 0% commission for first year

- Focus on reliability and uptime

- Community engagement

- Gradual stake growth

Timeline to profit: 12 months Final outcome: $100K+ annual profit

Best for: Those with technical skills and patience

Strategy 2: The Infrastructure Provider

Approach:

- Run validator with moderate commission (5-7%)

- Offer premium RPC/gRPC services

- Target developer customers

- Multiple revenue streams

Timeline to profit: 6-9 months Final outcome: $200-500K annual revenue

Best for: Those with infrastructure and business development skills

Strategy 3: The Community Validator

Approach:

- Serve specific community (e.g., Korean community, DeFi users)

- Moderate commission (7-10%)

- Community-focused marketing

- Value-added services

Timeline to profit: 9-15 months Final outcome: $150-300K annual revenue

Best for: Those with strong community connections

Strategy 4: The Institutional Validator

Approach:

- High initial stake (self-funded or partnerships)

- Professional operation from day one

- Target institutional delegators

- Premium services

Timeline to profit: 3-6 months Final outcome: $500K-2M+ annual revenue

Best for: Well-capitalized entities with institutional relationships

The Bottom Line: Is It Worth It?

Let's cut through everything and answer the key question: Should YOU run a Solana validator?

The Financial Case

Pros:

- $80-120K annual profit potential (with modest stake)

- Scales dramatically with more stake

- Multiple revenue streams possible

- Growing network activity trending upward

- Additional revenue from data services

Cons:

- $15-30K first-year investment needed

- 6-12 months until profitability

- Ongoing time commitment required

- Market and network activity risk

- Technical challenges to manage

The Non-Financial Factors

Why people do it beyond money:

- Ideological: Support decentralization and network security

- Learning: Deep understanding of blockchain infrastructure

- Positioning: Build reputation in Solana ecosystem

- Strategic: Foundation for other Solana ventures

- Community: Be part of validator community

Who Makes Good Money

Looking at the broader validator economics:

Struggling (0-20th percentile):

- Under 50,000 SOL staked

- Operating at loss or barely breaking even

- ~132 of 1,900+ validators in this category

- Annual profit: $0-30K

Getting by (20-50th percentile):

- 50,000-150,000 SOL staked

- Covering costs but not thriving

- Annual profit: $30-70K

Doing well (50-80th percentile):

- 150,000-500,000 SOL staked

- Solid profit margins

- Annual profit: $70-200K

Crushing it (80-100th percentile):

- 500,000+ SOL staked

- Multiple revenue streams

- Annual profit: $200K-2M+

Frequently Asked Questions

How much SOL do I need to start a validator?

You technically need only ~0.5-1 SOL to start (for rent exemption and voting costs). But realistically, you need significant delegated stake (50,000+ SOL) to be profitable. You don't need to own this—delegators stake with you.

What if I can't attract enough stake?

This is the biggest challenge for new validators. Strategies include:

- Start with 0% commission

- Build reputation on testnet first

- Engage actively in community

- Offer unique value (like premium data access)

- Be patient—it takes time

Can I run a validator from home?

Technically possible but not recommended. Requirements:

- Extremely stable internet (>1 Gbps)

- Reliable power with backup

- Proper cooling

- 24/7 availability

Most validators use data centers for reliability.

How technical do I need to be?

You need:

- Comfortable with Linux command line

- Basic networking knowledge

- Ability to follow documentation

- Troubleshooting skills

- Willingness to learn

If you can install and manage a Linux server, you can learn to run a validator with community help.

What happens if my validator goes offline?

Consequences:

- Miss voting rewards while down

- Reputation damage if frequent

- Delegators might leave

- Network security slightly reduced

No slashing: Unlike some other chains, Solana doesn't slash (penalize) validators for downtime, but you lose rewards.

Is now a good time to start?

Favorable factors in 2025:

- Network activity is high

- Infrastructure has improved significantly

- Community support is strong

- Transaction fees are lucrative

Challenges:

- Competition is fierce

- Market timing uncertainty

- Stake acquisition is hard

If you're committed for 12+ months and have capital to invest, the current environment is reasonable for starting.

How does validator profitability compare to just staking?

Simple staking:

- Earn ~7-8% APY

- Zero time investment

- Zero technical knowledge needed

- No operational costs

Validator operation (assuming 450K SOL stake):

- Earn ~12-15% APY equivalent

- 5-10 hours weekly time investment

- Technical knowledge required

- ~$15K annual operational costs

Validators earn more per SOL, but only worthwhile if you have or can attract significant stake and don't mind the work.

Can this scale into a serious business?

Absolutely. Top validators operate as legitimate businesses:

- Multiple employees

- Professional infrastructure

- Diversified revenue (staking + RPC/gRPC services)

- Institutional clients

- Multi-million dollar annual revenue

Many started exactly where you are now, learning and building over 1-2 years.

Your Next Steps: Taking Action

If you've read this far, you're seriously considering validator operation. Here's what to do next.

Immediate Actions (This Week)

- Join Solana Discord - Connect with the validator community

- Read official documentation - Start with docs.solana.com

- Set up testnet validator - Get hands-on experience risk-free

- Calculate your economics - Use your own assumptions about stake

Medium-Term Goals (Next 1-3 Months)

- Master testnet operation - Achieve 99%+ uptime

- Build monitoring systems - Know your validator's health 24/7

- Network with other validators - Learn from those ahead of you

- Plan your mainnet launch - Set realistic expectations

Long-Term Vision (6-12 Months)

- Launch mainnet validator - Start your profitability journey

- Attract delegators - Build trust through performance

- Optimize operations - Reduce costs, improve reliability

- Explore additional revenue - Consider gRPC/RPC services

How Solana gRPC Can Accelerate Your Success

Whether you're running a validator or building applications on Solana, data access is critical.

For Validators

Monetize your infrastructure by providing high-performance data access:

- Partner with established gRPC providers

- Offer premium endpoints to customers

- Generate additional revenue streams

- Differentiate from validator-only operators

For Developers

Build better applications with ultra-low latency data:

- Real-time streaming vs polling overhead

- 70% faster than traditional RPC

- Reliable infrastructure for production apps

- Focus on your application, not infrastructure

For Both

The Solana ecosystem grows stronger when validators and developers work together. Quality infrastructure enables quality applications, which drive more network activity, benefiting everyone.

Join our waitlist to learn how Solana gRPC can support your validator operation or power your next Solana application.

Conclusion: The Real Story of Validator Profitability

So, how profitable is running a Solana validator? The honest answer: it depends, but the potential is real.

What we know for certain:

- Profitability is achievable (real examples exist)

- $100K+ annual profit possible with modest stake

- Scales dramatically with more stake

- Multiple revenue streams available

- Takes time and commitment

The path forward:

- Start with realistic expectations

- Invest time in learning

- Budget for 6-12 month runway

- Build reputation through reliability

- Consider additional services (gRPC/RPC)

Running a Solana validator isn't a get-rich-quick scheme. It's a real business that rewards technical competence, reliability, and patience. For those willing to put in the work, the financial and strategic rewards can be substantial.

The validator in our case study proves it's possible to reach profitability in about a year, even with 0% commission. With the right approach, you could be next.

Ready to start your validator journey? The Solana network needs more dedicated operators. Whether you end up running a validator or building applications that need reliable data access, the ecosystem has room for committed participants.

This post was last updated on September 29, 2025. Validator economics change with network conditions and market prices. Always do your own research and calculations before making financial decisions.

Questions about validator operations or need reliable gRPC infrastructure? Reach out to our team—we're here to help you succeed in the Solana ecosystem.

Related Posts

Introduction to Solana gRPC: Developer's Guide

Learn how to integrate Solana's high-performance gRPC interface into your applications for faster blockchain interactions and better scalability.

How to Use Solana gRPC Geyser Plugin for Ultra-Low Latency Data Streaming

Learn to implement Solana gRPC streaming with Yellowstone for real-time blockchain data access - significantly faster than traditional RPC methods.